car sales tax in fulton county ga

After the Tax Sale. Except when the first Tuesday of the month falls on a legal holiday in.

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

The December 2020 total local sales tax rate was also 7750.

. The current TAVT rate is 66 of the fair market value of the vehicle. For vehicles that are being rented or leased see see taxation of leases and rentals. TAVT is a one-time tax that is paid at.

Registration renewals at the kiosks have no additional charges for Fulton County residents. What is the sales tax rate in Fulton County. The Motor Vehicle Division collects applicable ad valorem taxes issues metal platesdecals and registrations to automobiles trucks motorcycles tractor trailers.

Documents necessary to claim excess funds in Fulton County below are the instructions on submissions. The minimum combined 2022 sales tax rate for Fulton County Georgia is. This is the total of state and county sales tax rates.

Ferdinand is elected by the. On Tuesday August 2 City of Fulton residents have an opportunity to vote on continuing a vehicle sales tax on motor vehicles trailers boats and. Get started Youll need your VIN vehicle sale date and.

5901 Koweta Rd South Fulton GA 30349 159900 MLS 20024501. Kroger 2685 Metropolitan Parkway. Title Ad Valorem Tax TAVT became effective on March 1 2013.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Fultons rate inside Atlanta is 3. There is also a local tax of.

The entity or individual leasing the. You may visit a kiosks inside one of the following locations. Download all Georgia sales tax rates by zip code The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe.

2016 City of Fulton Vehicle Tax Proposal. The current total local sales tax rate in Fulton County GA is 7750. 404-613-6100 Tax Commissioner Homepage 141 Pryor Street SW Atlanta GA 30303 Tax Commissioner Fulton County Tax Commissioner Dr.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. If the vehicle was purchased in Georgia between January 1 2012 and March 1 2013 and titled in this state the owner is eligible to opt into the new system. Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

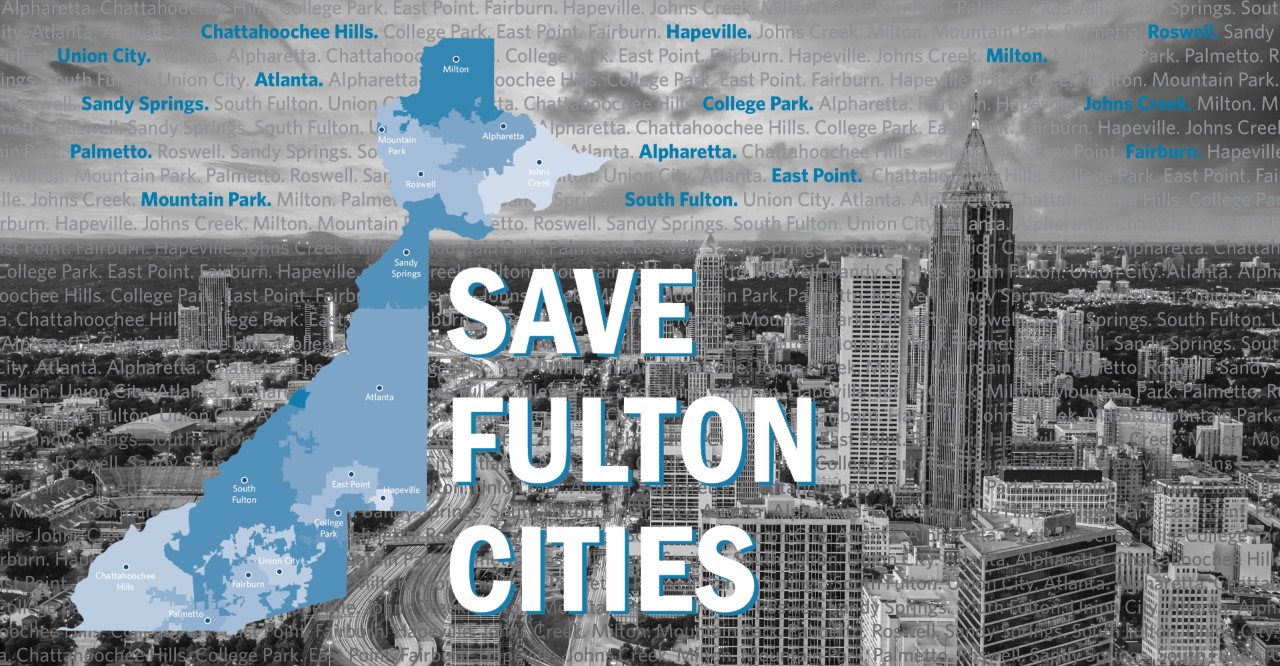

Fulton County Cities To Resume Mediation Over Sales Tax Distribution Reporter Newspapers Atlanta Intown

Transfer Of Tax Fifa S In Georgia Gomez Golomb Llc

Fulton County Ga Businesses For Sale Bizbuysell

Reminder For Today Dickens Fellow Fulton Mayors Highlight Sales Tax Role In Funding Public Safety City Of Fairburn Ga

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

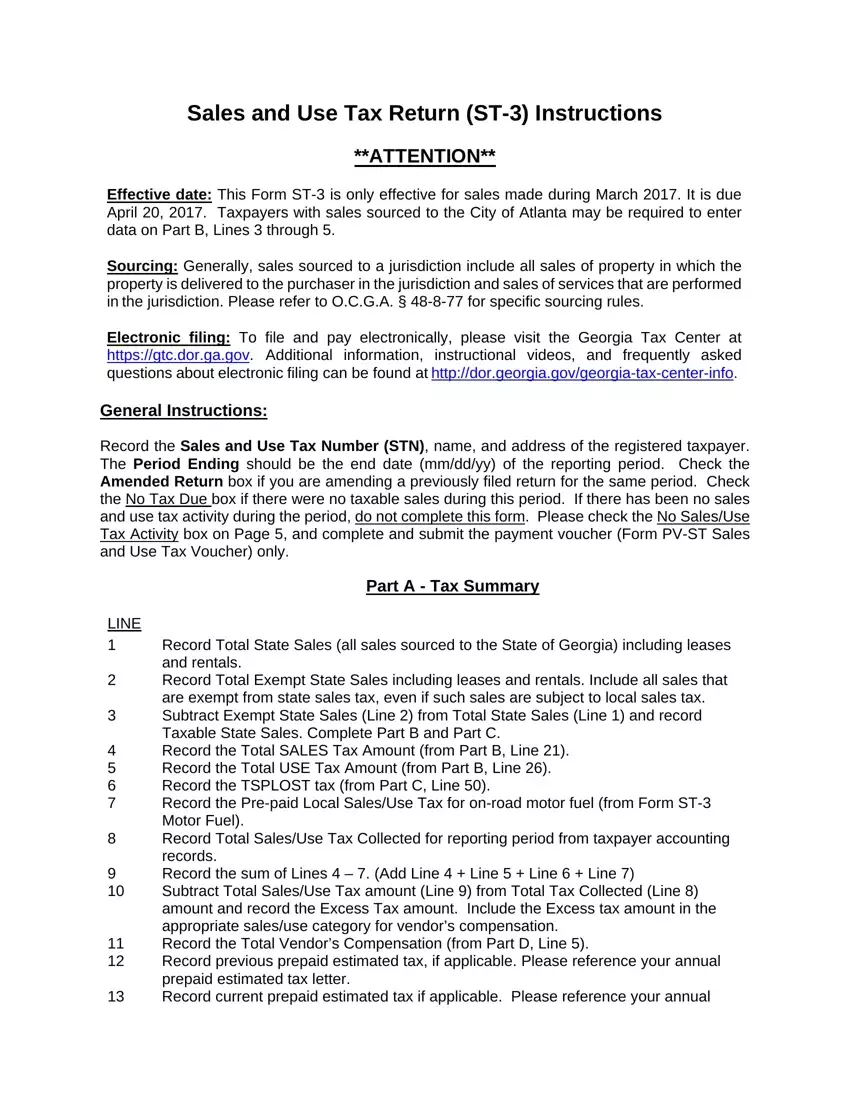

Ga St 3 Tax Fill Out Printable Pdf Forms Online

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

Georgia Sales Tax Small Business Guide Truic

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

Vintage 1999 Georgia License Plate Fulton County Ebay

![]()

Car Sales Tax In Georgia Explained And Calculator Getjerry Com

Georgia Legislature Changed The Way Car Sales Are Taxed

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

-388459-edited.png?width=799&name=Copy%20of%20Georgia%20Tax%20Rates%20(3)-388459-edited.png)